LOCAL NEWS

Glasgow City Council meeting celebrates the city’s past and plans for the future

Glasgow City Council takes a look back on the 225 year the city has existed, and looks to the future with an annual report from the Planning and Zoning Commission.

Peggy Pippin fills vacancy on Cave City Council after Monday meeting

The vacant Cave City Council seat was filled at Monday’s special called meeting. Mayor Hatcher updates the public on annexation as well.

Barren County Tax Deed Report For The Week Of April 15, 2024

The following property transfers were recorded at the Barren County Clerk’s Office from April 15, 2024 to April 19, 2024.

LOCAL SPORTS

Hot Rods’ offensive surge propels first road victory of the season over Greenville Drive

BOWLING GREEN – Duncan Davitt dominated on the mound, hurling 5.2 hitless innings. Meanwhile, the

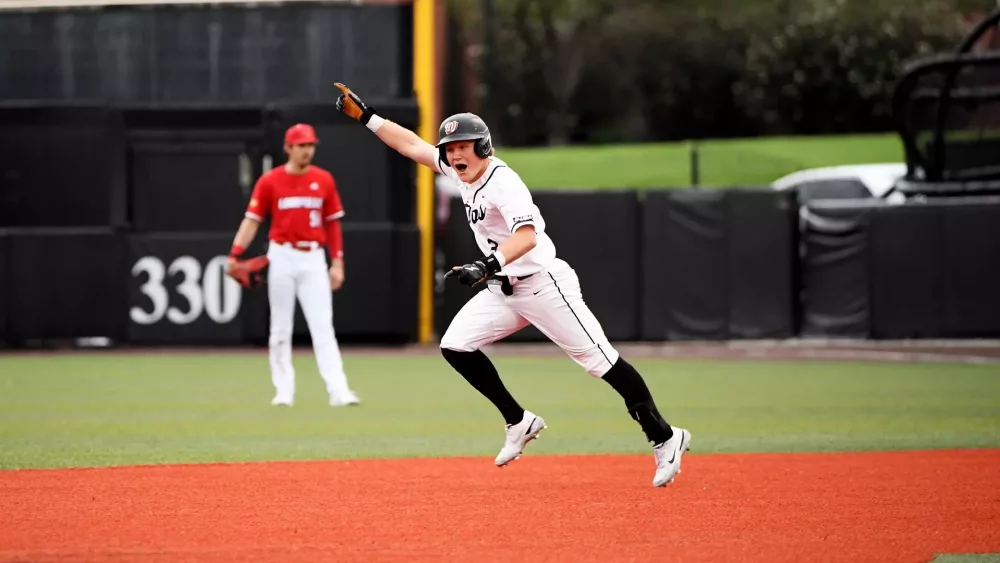

WKU tops Louisville 3-2 with walk-off single in extra innings to secure first win over the Cards since 2015

BOWLING GREEN – Junior Eli Burwash emerged as the hero for Western Kentucky on Tuesday, propelling WKU to a thrilling 3-2 extra-inning victory over the Louisville Cardinals.

OBITUARIES

Raymond Earl Eatmon

Raymond Earl Eatmon, age 69 of Cave City, departed this life at his home, with his family by his side on Sunday

Charles Robert “Robbie” Green

Charles Robert “Robbie” Green, age 55, of Leitchfield, KY, passed away Sunday

Helen Furlong Kinslow McCandless

Helen Furlong Kinslow McCandless, 91, of Park City, released this world with all six of her children by her bedside.

Lizzie Bell Cook

Lizzie Bell Cook, age 97 of Three Rivers, Michigan, departed this life on Friday, April 19, 2024

KENTUCKY NEWS

Glasgow Police Officer injured, wife deceased in two-vehicle accident

WCLU News was notified about this tragedy yesterday evening. In light of the events that occurred, local coverage of this will commence at a more appropriate time. Our thoughts and prayers are with Officer Murrell, his family,

Kentucky State Police Identify Homicide Victim from 1990 Cold Case

On January 7, 1990, an unidentified male was found deceased in a wooded area off of Pleasant Valley Road in Philpot, KY

Mammoth Cave National Park Will Have Free Events This Saturday to Kick off National Park Week

Mammoth Cave National Park will kick off National Park Week with the annual Wildflower Day celebration

New Traffic Signal on Campbell Lane in Bowling Green to Become Operational On Thursday

A new traffic signal on U.S. 231 Campbell Lane in Bowling Green is expected to become operational later this week.

CHURCH & COMMUNITY CALENDAR

Southern KY Community Action Garden Program Begins April 1

Southern Kentucky Community Action Garden Program begins April 1 and ends May 15

Mary Wood Weldon Memorial Library- April Calendar of Events

April 2024 Calendar of Events -Mary Wood Weldon Memorial Library

Daphne Pace Solberg, an Investigative Genetic Genealogist will Speak at the Historical Society Meeting

The Barren County Historical Society presents Daphne Pace Solberg, an Investigative Genetic Genealogist, on Thursday, April 25th

Hopewell Baptist Church will hold a Spring Revival

Hopewell Baptist Church Spring Revival will be held from Thursday, April 25 and Friday, April 26

national news

sports

entertainment